There’s little connection between cash in economy and corruption

Cash in circulation in an economy has little correlation with corruption, a comparative analysis of World Bank and Transparency International data suggests, deepening suspicion that those with black money prefer to keep their ill-gotten wealth in other forms of assets.

Cash in circulation in an economy has little correlation with corruption, a comparative analysis of World Bank and Transparency International data suggests, deepening suspicion that those with black money prefer to keep their ill-gotten wealth in other forms of assets.

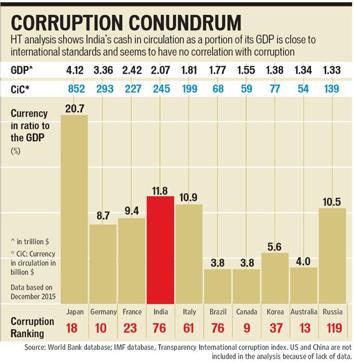

While figures show that India holds 11.8% of its economy in cash and is ranked a poor 76th in the global corruption ranking. Germany, at 9th in the graft ranking, has an 8.7% cash economy.

Sweden, one of the world’s top three least corrupt countries, and Nigeria, one of the worst, has near similar proportion of cash in their economies.

The findings raise further doubts over the efficacy of the Centre’s drive against black money by demonetising 500 and 1,000 currencies since most of the unaccounted for wealth in the country is perhaps not held in cash.

Prime Minister Narendra Modi on November 8 announced the recalling of Rs 500 and Rs 1000 with the twin purpose of absorbing black money held in cash and to check counterfeit currencies.

Read: Why govt’s demonetisation move may fail to win the war against black money

Critics of the demonetising scheme argued the move would do little to unearth black money hoarded by the rich who park their cash in different asset classes than keep it idle. Hindustan Times on Saturday reported that cash recovery has been less than 6% of the undisclosed income seized from tax evaders.

Hindustan Times analysed the cash in circulation and GDP of 26 countries – 12 top economies barring the US and China, 12 very corrupt countries with stable governments, and three mid-sized economies with varying corruption ranks.

The findings suggested India’s cash in circulation as a portion of GDP was near about international standards.

France, for example, holds 9.4% in cash and is ranked 23 by the anti-graft body, Transparency International. Experts said India’s marginally more cash proportion could be because a majority of Indians depend on cash for daily transactions in absence of inadequate banking facilities.

Japan, the world’s third largest economy and ranked 18th on the corruption index, has 20.7% cash economy.

The analysis of data showed up another interesting fact: Russia, the world’s 13 largest economy and Spain, the 14th largest, shared the same proportion of cash economy.

Yet, Russia is ranked 119 on the corruption index while Spain is a lot cleaner at 36. Corruption, the data suggested, had little impact on their cash in circulation.

Read: Opposition rattled, criticism of demonetisation move baseless: Venkaiah

Stay informed on Business News, TCS Q4 Results Live along with Gold Rates Today, India News and other related updates on Hindustan Times Website and APPs